Cara Mengelola Keuangan Usaha Kecil Untuk Pemula

Pelajari cara mengelola keuangan usaha kecil agar bisnismu makin berkembang dan terhindar dari masalah finansial dengan tips praktis untuk pemula di sini

Cara Meningkatkan Omzet Tanpa Tambah Modal Biar Omzet Naik

Cari tahu cara meningkatkan omzet tanpa tambah modal dengan strategi jitu yang mudah diterapkan untuk UMKM agar bisnis makin berkembang dan omzet naik pesat

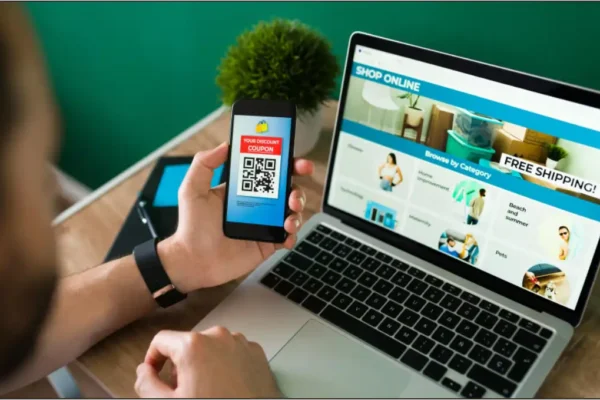

Cara Optimasi Toko Online Cepat Laku Tanpa Ribet

Temukan cara optimasi toko online cepat laku agar produkmu lebih mudah terjual tanpa ribet, cocok untuk pemula dan pebisnis yang ingin hasil maksimal

KONGBET268 Link Alternatif Resmi untuk Login dan Daftar Bet Slot Online

Temukan link alternatif resmi KONGBET268 untuk login dan daftar bet slot online dengan mudah dan aman, serta nikmati pengalaman bermain tanpa kendala akses

Cara Pasang Iklan Instagram Untuk Umkm Biar Cepat Jalan

Pelajari cara pasang iklan Instagram untuk umkm agar penjualan bisnis kecil makin berkembang dan usaha kamu cepat dikenal banyak orang di media sosial sekarang

Cara Pasang Iklan Facebook Untuk Umkm Yang Aman

Pelajari cara pasang iklan facebook untuk umkm agar promosi bisnis lebih efektif dan aman, serta optimalkan anggaran pemasaran sesuai kebutuhan usaha Anda.

Cara Membuat Konten Jualan Harian Untuk Pemula

Pelajari cara membuat konten jualan harian yang efektif agar bisnis online kamu semakin berkembang dan bisa menarik lebih banyak pelanggan setiap hari